Six Times Lucky Pocket Fm Full Episodes Free

Author: Ryan Phillips Narrator: Emily Brown Rating 4.4 35 Reviews 467.6K Plays 31 hrs 17 mins Length Summary Amy’s perfect life shatters when […]

Author: Ryan Phillips Narrator: Emily Brown Rating 4.4 35 Reviews 467.6K Plays 31 hrs 17 mins Length Summary Amy’s perfect life shatters when […]

Traya Health Coupon Code, Discount Code | April 2024 – Dealsexport Traya Health Coupon Category Traya Health Offers & Discount […]

Hello Guys I Hope You Are Doing Well And Enjoying Your Previous Post, If You Are Tired Of Searching Pocket […]

Vidmate Cash invite Code March– “HD9SEM” Vidmate Cash Invite Code New, Vidmate Cash Referral Code “HD9SEM”, – Hello And Welcome Friends I […]

Jiocinema Promo Code Free Jiocinema Promo Code, JioCinema is A Popular Indian Streaming Platform That Offers A Diverse Range of […]

Kuku FM premium Subscription code 2024 :- Hello Everyone I Hope You are Enjoying Free Recharge Tricks & Free Paytm […]

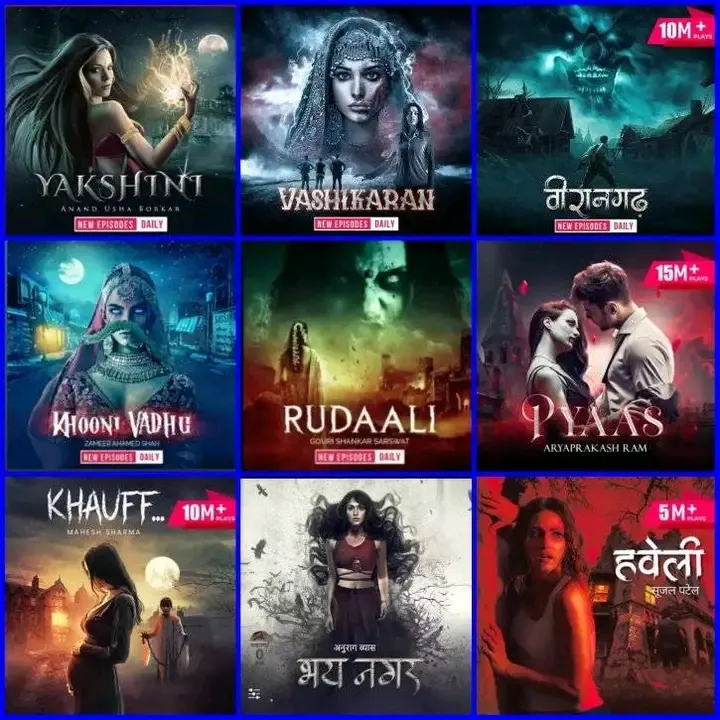

Whether You’re A Seasoned Horror Fan Or Just Diving Your Toes Into The Genre, There’s No Better Way For You […]

Money Earning Apps in India 2024 Money Earning Apps In India April 2024 New Earning App 2023 Paytm cash, New […]

Best Pocket FM Horror Stories List If You Love Listening To Horror Stories, Then You Are In Our Horror Story […]

Pocket FM English Stories list: Are You Also One Of Those People Who Like Pocket FM Audio Stories in English? If […]