Top 10 Pocket FM Horror Stories List (Updated 2025)

Are you ready to dive into a world of spine-chilling audio horror? If ghostly whispers, cursed spirits, and haunted mysteries are your thrill of choice, Pocket FM has you covered. […]

Are you ready to dive into a world of spine-chilling audio horror? If ghostly whispers, cursed spirits, and haunted mysteries are your thrill of choice, Pocket FM has you covered. […]

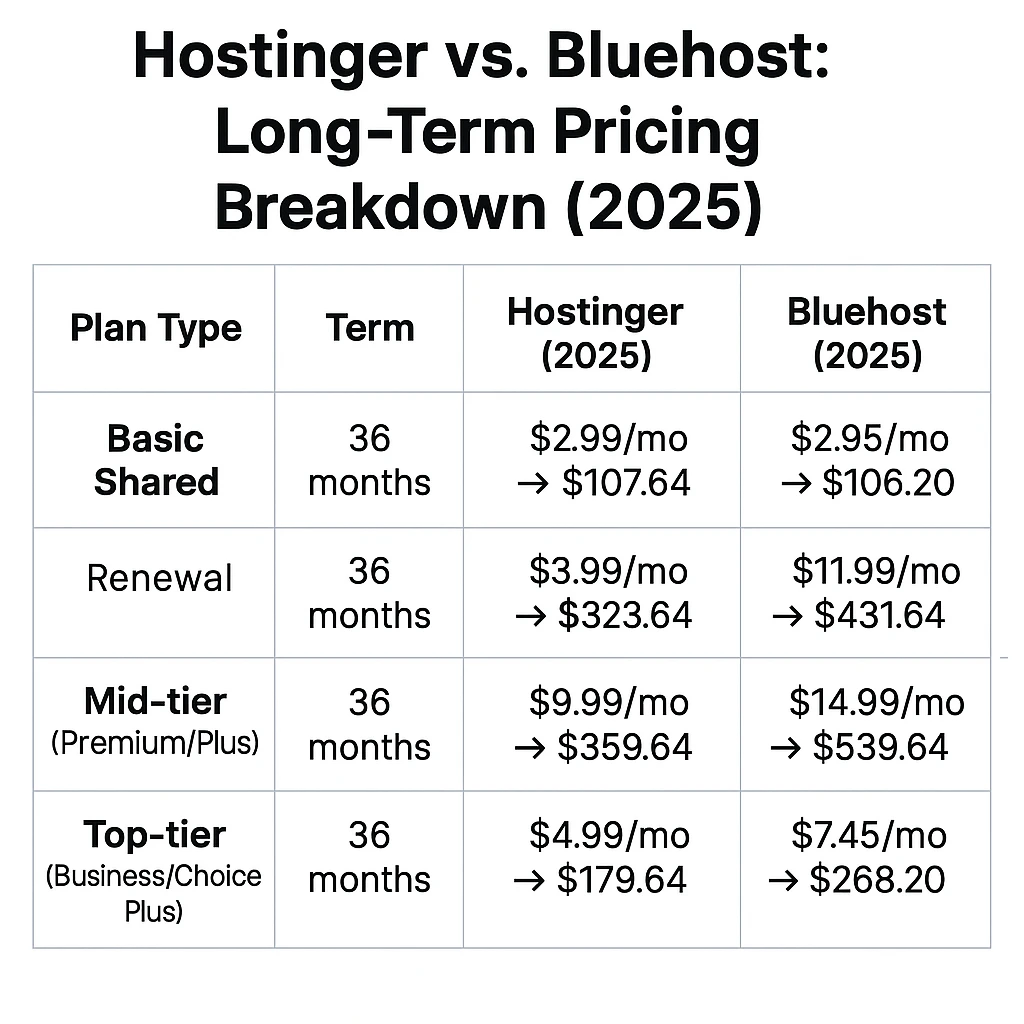

Hostinger vs. Bluehost: 5-Year Cost Breakdown Winner Revealed! $0 $500 $1,000 $1,500 $2,500 Hostinger $1,368.95 Bluehost $2,334.00 Total Savings with Hostinger: $965.05 (41% Less) Choosing a web host requires looking […]

Hosting Pricing Analysis 48-Month Hosting Plan Pricing Comparison Hostinger Starter Plan Price History (2023-2025) HORIZON2025 Code Success Rate Expired Codes Success Rate Regional Discount Differences Region Discount Visualization Other Coupon […]

Do You Know That You Can Enjoy A Huge Collection Of Stories And Audiobooks For Free? Yes It Is True, Today I Will Give You Information About How To Listen […]

Kuku FM Premium Subscription for Free – Hello everyone! Are you enjoying free recharge tricks and Paytm cash offers? Today, we bring an exciting deal for you! With our exclusive […]

Discover the ultimate audio experience with Pocket FM Promo Code April 2025! Unlock free coins, discounted subscriptions, and ad-free access to Pocket FM’s 100,000+ audiobooks, podcasts, and gripping series like […]

Music has the power to transform any moment, whether you’re at a lively bar, a cozy restaurant, or a social gathering with friends. TouchTunes, a leading digital jukebox platform, brings […]

Are you hooked on the thrilling audio drama The Return of Tiger on Pocket FM? You’re not alone! With over 34.4 million plays and a stellar 4.4 rating from 8.6K […]

Are you tired of ads interrupting your Jio Cinema experience, whether you’re streaming IPL matches, Bollywood blockbusters, or exclusive series? While Jio Cinema offers free access to a vast library […]

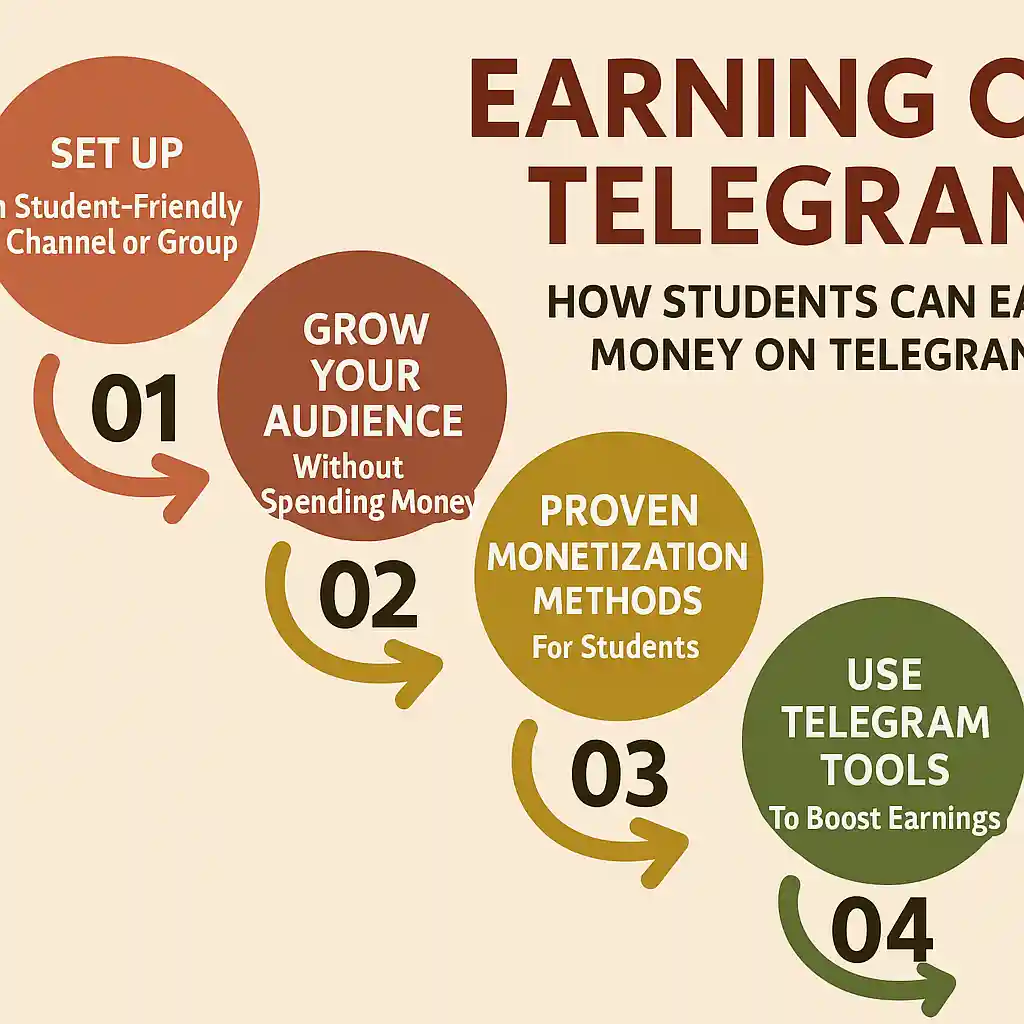

In 2025, Telegram stands out as a goldmine for students looking to earn money without any upfront investment. With its massive user base—now exceeding 800 million monthly active users—and innovative […]