Life insurance: General Insurance

What is insurance: Life insurance General Insurance

What is the insurance premium?, What are the types of insurance?, What is insurance? – Hello Export Readers!! Here I Am Back With Another New Topic With “What is insurance? – Life insurance: General Insurance” I hope Your Good And enjoying Previous Investment, insurance, Refer And Earn, Free Tricks And Cashback Offers And Many More Loot Deals

As You Know That In Our Website Daily I Come With A New And Interesting And Best Offer and Topic Today In This Post We Are Come Back A With A New Topic Name Is What is insurance? – Life insurance: General Insurance And This Is Very Popular Topic. I Have Explained Everything In Simple Language. Keep Reading Below.

Insurance:

We All Have Heard A Lot About Insurance. As A General Concept, Insurance is Something That Sustains You Or The Things You Have Insured A Heavy Financial Loss. But There’s More To It Than Just A Cover For Something That You Think Is Capable Of Taking Damage. We Will Look At It In Detail.

What Is Insurance?

In Technical Terms, It Is A Form Of Risk Management Where The Insured Entity Transfers The Cost Of Potential losses to Another Entity In Exchange For a Small Financial Compensation. This Compensation Is Called As Premium . Simply Put, It’s Like Paying An Entity a Lump Sum To Protect Itself Against Potential Future Losses. Thus, When Something Unfortunate Happens, The Insurer Helps You Through The Situation.

Why Do We Need Insurance?

This is The Question On Everyone’s Mind. Do I Really Need Protection? Life is full of surprises; Some good, some bad. You have to be prepared for the worst that can come your way. It helps you feel safe and calm. There can be many reasons where you may need help, such as serious illness, natural disasters, unexpected death of a loved one, etc. Adequate insurance in such situations provides an important helping hand to your financial situation. Thus, one should choose the right type of protection according to their needs.

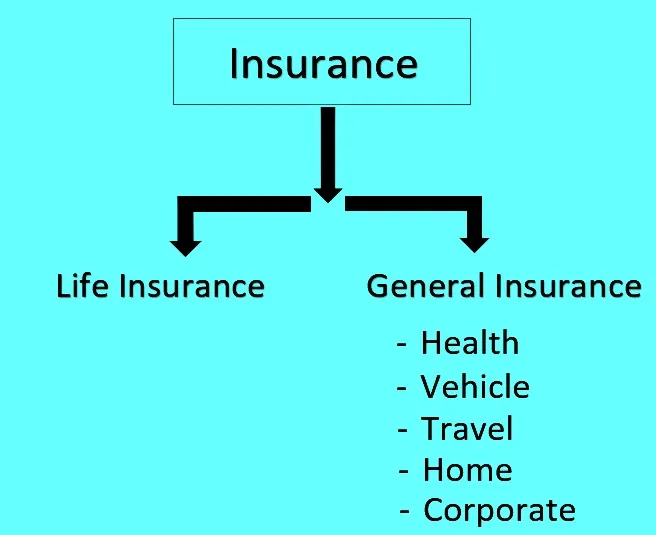

Types of Insurance:

1. Life insurance:

Life insurance is a Contract Entered Into Between An Insured and an Insurance Company; Where The Insurance Company Gives An Assurance That On The Death Of The Policyholder, a Certain Sum Will Be Paid To The Heirs Of The Policyholder. As Per The Terms of The Contract, The Insured Gets Paid even if he is Sometimes Seriously Ill. The Policyholder Usually Pays A Fixed Amount To The Insurance Authority at One Time Or For A Fixed Period Of Time .

The Benefit To The Insured Is The Gain of “Peace Of Mind”; Because he knows That After His Death His Heirs will not be in Financial Trouble.

This Method Is Also Used To Get Financial Benefits After Retirement, if The Policyholder Takes The Insurance Cautiously And States So In The Terms And Conditions.

Life Insurance Is A Legal Contract And the Terms Of The Contract Are Limited by The Coverage Of The Insurance. Here The Special Conditions Are written And The Responsibility Rests With The Insured; For Example , in case of Death Due To Suicide , War Etc., no Payment Is Made By The Insurance Authority To The Heirs Of The Policyholder.

2. General Insurance

Any Kind Of Coverage Other Than Life Comes Under This Category. There are Many Types Of Insurance That Cover Almost Every Aspect Of Your Life Depending On Your Needs:

A. Health insurance

It Covers Your Medical And Surgical Expenses That May Occur During Your Lifetime. Generally, health insurance Provides Cashless Benefits in Registered Hospitals.

B. Motor insurance.

It Covers Damages And Liabilities Related To A Vehicle (Two Wheeler Or Four Wheeler) Under Various Circumstances. It Provides Protection Against Damage to The Vehicle And Provides Cover For Third Party Liability As Per Law Against The Vehicle Owner.

C. Travel insurance

It covers You Against Emergencies Or Damages During Your Travels. It Covers You Against Unforeseen Medical Emergencies, Theft Or Loss Of Luggage Etc.

D. Home insurance

It covers the house and/or contents Depending On The Scope Of The Policy. It Protects The House From Natural And man-made calamities.

E. Marine insurance

It Covers Goods, Cargoes Etc. From Possible Damage Or Loss During Transit.

F. Commercial insurance

It Provides Solutions For All Sectors Of Industries Like Construction, Automotive, Food, Energy, Technology etc.

Risk Protection Needs May Differ From Person To Person But The Basic Function Of An Insurance Policy Remains More Or Less The Same.

How does insurance work?

The Most Basic Principle Behind The Concept of Insurance Is ‘ Risk Pooling ‘ A Large Number Of People Are Ready To Get Insurance Against A Particular Loss Or Damage And For This, they are Ready To Pay The Desired Premium. This Group Of People Can Be Called Insurance-pool. Now, The Company knows that the number of interested People Is Huge And The Chances Of all of Them Needing Insurance Cover At The Same Time Is Almost Impossible. Thus, it Allows Companies To Collect Money At Regular Intervals And settle Claims When Such Conditions Arise The Most Common Example Of This is Auto Insurance . We all have car Insurance, But How Many Of Us Have Made A Claim For It? In This Way, you Pay For The Possibility Of Loss and get Insured And You Will Be Paid If The Given Event Occurs.

So When You Buy An Insurance Policy, You Pay A Regular Amount To The Company As Premium For The policy. If And When You Decide To Make a claim, the Insurer Will Pay The Compensation Covered By The Policy. Companies Use Risk Data To Calculate The Probability of The Event – You’re Seeking insurance for – Happening The Higher the probability, The Higher The Policy Premium. This process is called Underwriting I.e. The Process Of Evaluating The Risk Of Insurance. The Company seeks only the actual value of The Entity Which Is Insured As Per The insurance contract entered into Between The Parties. For example, you Have Insured Your Ancestral house for 50 Lakhs, The Company Will only Consider The Actual Value Of The House And There Will Be No Emotional Value Of The House For You, as it is Almost Impossible To Value On Emotions.

Different Policies Have Different Terms And Conditions, But Three Main general Principles Remain The Same For All Types.

- The Cover Provided For A Property Or Item Is For Its Actual Value And Does Not Consider Any Sentimental Value.

- The Probability Of A Claim Should Be Spread Among The Policyholders So That The Insurers Are Able To Calculate the Chance Of Risk In Setting The Premium For The Policy.

- Harm Should Not Be Intentional.

We Have Covered The First Two Points above. The third part is a little more Important To Understand.

an insurance Policy Is A Special Type Of contract between the Insurer And The Insured. It is a Contract Of ‘Absolute Good Faith’. This Means That There Is An Unspoken But Very important understanding Between The Insurer And The Insured That Is Not Usually Contained In Regular Contracts. This Understanding Includes The Obligation Of Full Disclosure And Not To Make Any False or Fraudulent Claims. This duty of ‘Good Faith’ Is One Of The Reasons why a Company May Refuse To Settle Your Claim If You Fail To Inform Them of all The Necessary Information. And It’s a Two-way Street. The Company Has A ‘Good Faith’ Obligation To The Client And Failure To Act On This Can Land The Insurer In A Lot Of Trouble.

Conclusion

Every Word Is Economic Planning risk Is Backed By Protection. A Suitable Cover For You Is Determined By Your Needs And Current Financial Situation. You Should Review And Re-examine The Expenses Covered In Your Policy and Assess Their Impact On Your Current Financial Health. There Are Many Ifs And Buts Involved But The Basic Fundamentals Of The Job Remain Constant Across All types of Insurance You Must Be Clear About What Type Of Risk Protection You Are Buying, Why You Are Buying It And What Is Included In The Contract. It is also Important For Both Parties To Act in ‘Utmost Good Faith’ So That The Entire Process Of Insurance Is Crystal Clear And Less Hassle. And As with Every Financial Product, You Must be well Versed And Informed About the Product You Are Buying And Get proper Advice From Your Financial Advisor.

Why should I purchase insurance?

With a Policy, You Can Effectively Transfer a Potential Loss To An Insurance Company. You Can Do So In Exchange For A Fee Known as ‘Insurance Premium’. The Benefit Of Insurance Is That It Protects Your Savings In Case Of An Unexpected Expense.

Can I purchase multiple insurance policies?

Yes, A Person Can Buy Different Types Of Policies. There is also no Limit To The Number Of Life Insurance Policies A Person Can Purchase. However, For A Car, You Need To Buy Only One Car Insurance Policy.

What is the insurance premium?

An Insurance Premium Is An Amount That The Insured Has To Pay Periodically To The Insurance Company For Purchasing The Policy. When You Purchase An Insurance Policy, The Risk Is Transferred To The Company. Hence, The Company Charges A Fee, Known As An Insurance Premium.