Are you looking for a hassle-free banking option that also puts some extra cash in your pocket? Chime, an innovative online banking platform, might be just what you need. With its no-fee structure, early direct deposit, and user-friendly app, Chime is gaining popularity fast. Even better, their referral program lets you earn a $100 bonus when you sign up using a referral link and meet a simple requirement. Curious? Let’s dive into everything you need to know about Chime and how to score that $100 bonus!

What is Chime?

Chime isn’t your typical bank—it’s a financial technology company that partners with FDIC-insured banks to offer modern banking services. Think of it as banking designed for the digital age. With Chime, you get a Spending Account (like a checking account) and an optional Savings Account, all accessible through a sleek mobile app or website. Here’s what makes Chime stand out:

- No Monthly Fees: Say goodbye to pesky maintenance charges.

- No Minimum Balance: Keep as little or as much as you want in your account.

- Early Direct Deposit: Get your paycheck up to two days early when you set up direct deposit.

- Automatic Savings: Features like rounding up purchases to save the change make building your savings effortless.

Chime is perfect for anyone tired of traditional banking headaches and looking for a fresh, convenient alternative.

Step-by-Step Guide How to Join Chime Bank?

Follow these steps to create your Chime account, use a referral link, and unlock that $100 bonus. It’s simple and takes just a few minutes.

Step 1: Download the Chime App

Kick things off by grabbing the Chime app—it’s free and works on both iPhones and Android devices. Head to the Apple App Store or Google Play Store, search for “Chime,” and hit download. The app is your gateway to managing your money, from checking balances to setting up deposits.

Step 2: Start the Sign-Up Process

Open the Chime app and tap “Sign Up.” You’ll be prompted to enter some basic info:

- Full name

- Email address

- Phone number

- Home address

This part’s quick and straightforward, just like filling out a form for any online service. Make sure your details are accurate to breeze through the next steps.

Step 3: Use a Referral Link for the Bonus

Here’s where the $100 bonus comes in. Chime uses referral links instead of codes, so you’ll need to start your sign-up through a friend’s unique referral link. For example, you might use a link like the one shared by a Chime user (we’ll keep it general here, but ask a friend for theirs!).

When you click a referral link, it directs you to the sign-up page with the referral automatically applied—no need to enter a code manually. If you’re already in the app and see a “Referral Code” or “Promo Code” field during sign-up, you can enter a code like “welcome100” if provided by your referrer, but the link usually does the trick. Double-check with your friend to ensure you’re using their correct link for the bonus.

Step 4: Verify Your Identity

To keep things secure and comply with banking regulations, Chime will ask for a bit more info to confirm who you are. This typically includes:

- Social Security number (or part of it)

- Date of birth

Don’t worry—Chime uses top-notch encryption to protect your data, and this step is standard for any legit banking service. It only takes a moment, and you’re one step closer to your account.

Step 5: Get Your Chime Debit Card

Once your account is approved (usually instantly), Chime will mail you a Chime Visa® Debit Card—free of charge. It should arrive in 5–10 business days. When it does, open the app, tap “Activate Card,” and follow the instructions to get it ready for use. You can start using your account digitally even before the card arrives, so no waiting around!

Step 6: Set Up Direct Deposit to Unlock the Bonus

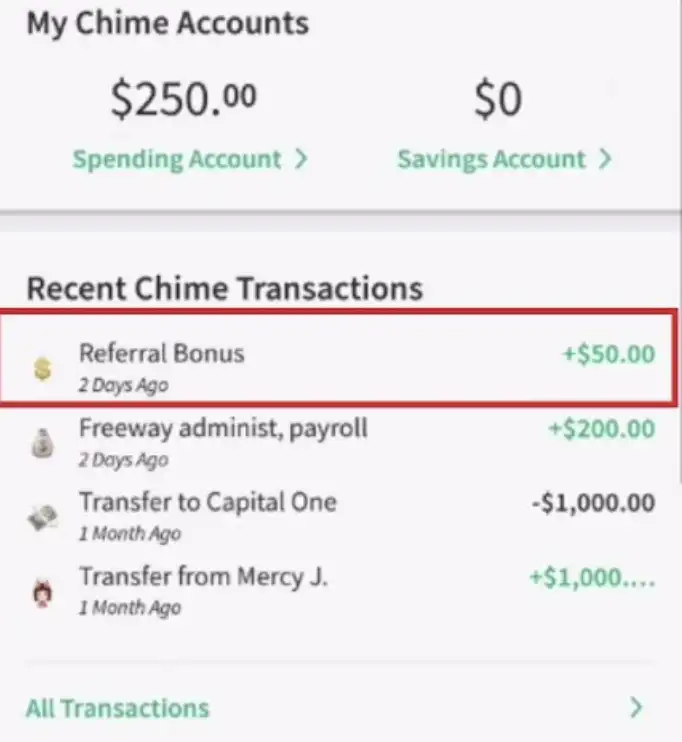

To score the $100 referral bonus, you need to receive a qualifying direct deposit of $200 or more within 45 days of signing up. Here’s how to set it up:

- In the Chime app, go to “Move Money” and select “Direct Deposit.”

- Follow the prompts to get your account and routing numbers or a pre-filled direct deposit form.

- Share these details with your employer, gig platform (like Uber or DoorDash), or government benefits provider (like Social Security).

Qualifying deposits include payroll, government benefits, or tax refunds—but not transfers from another bank or cash deposits. Once your deposit hits, Chime credits your $100 bonus (and your referrer’s) within two business days. Plus, with direct deposit, you’ll get paid up to two days early—a perk you’ll love every payday!

How the Referral Program Works

Chime’s referral program is a win-win for both existing customers and newbies. Instead of a traditional “bonus code” you enter, Chime uses unique referral links. Here’s the gist:

- An existing Chime customer shares their personal referral link with you.

- You use that link to sign up for a new Chime account.

- Within 45 days of opening your account, you receive a qualifying direct deposit of $200 or more.

- Once that deposit hits, both you and the person who referred you each get a $100 bonus—credited within two business days.

So, while the term “referral bonus code” is in the title (and commonly searched), it’s really about using a referral link. No complicated codes to type—just click, sign up, and deposit!

Step-by-Step Guide to Earning the $100 Bonus

Ready to grab your $100? Here’s how to do it, whether you’re new to Chime or want to refer someone:

For New Customers:

- Find a Referral Link: Ask a friend or family member who’s already a Chime customer for their referral link. (Pro tip: Make sure it’s from a legit source if you find one online!)

- Sign Up: Click the link, and you’ll be taken to Chime’s sign-up page. Provide your name, email, Social Security number, and other details to create your account.

- Set Up Direct Deposit: Link your payroll, government benefits, or another qualifying source to deposit at least $200 into your Chime Spending Account within 45 days.

- Get Your Bonus: Once your deposit is processed, Chime credits your $100 bonus within two business days.

- Enjoy!: Use your bonus however you like—treat yourself or save it for a rainy day.

For Existing Customers:

- Locate Your Link: Open the Chime app, go to the “Refer Friends” section, and find your unique referral link.

- Share It: Send it to friends via text, email, or social media—wherever they’ll see it.

- Earn More: When someone signs up with your link and meets the deposit requirement, you both score $100. There’s no limit to how many people you can refer, so keep sharing!

It’s straightforward, and the rewards add up fast.

Extra Tips for Success

- Act Fast: You’ve got 45 days from sign-up to get that $200+ direct deposit, so don’t delay setting it up.

- Check Your Link: Make sure you’re using a valid referral link from a current Chime user to qualify for the bonus.

- Explore the App: While waiting for your card, play around with the app to discover features like Round Ups (saves your change) or SpotMe (fee-free overdraft up to a limit).

What Counts as a Qualifying Direct Deposit?

The key to unlocking the $100 bonus is the qualifying direct deposit. Chime defines this as a deposit of $200 or more into your Spending Account within 45 days of signing up. But what exactly qualifies? Here are some examples:

- Payroll from Your Employer: Your regular paycheck is the most common option.

- Government Benefits: Think Social Security, disability payments, or unemployment benefits.

- Tax Refunds: A refund deposited directly from the IRS works too.

What doesn’t count? Manual transfers from another bank account, mobile check deposits, or cash deposits via ATMs. It has to be an electronic direct deposit from an eligible source. If you’re unsure, double-check with your employer or payer to ensure it’s set up correctly. Missing the 45-day window means missing out on the bonus, so act quickly!

Why Join Chime? The Benefits Beyond the Bonus

The $100 bonus is a sweet deal, but Chime offers plenty more to love. Here’s why it’s worth sticking around:

- Fee-Free Banking: No monthly fees, overdraft fees (up to a limit with SpotMe), or minimum balance fees. You keep more of your money.

- Early Paychecks: Get paid up to two days early with direct deposit—a lifesaver for covering bills or unexpected expenses.

- Savings Made Simple: Round up purchases to the nearest dollar and save the difference automatically, or set aside a percentage of each paycheck.

- Mobile Convenience: Manage everything from your phone—check balances, transfer money, or even block your card if it’s lost.

Sure, Chime doesn’t have physical branches, but their app and online support make banking a breeze. Plus, you can withdraw cash fee-free at over 60,000 ATMs in networks like MoneyPass and Visa Plus Alliance.

Why Choose Chime?

Before we dive in, let’s talk about why Chime’s worth your time. It’s not a traditional bank but a financial tech platform that teams up with FDIC-insured banks to bring you a Spending Account (like checking) and an optional Savings Account. Expect no monthly fees, no minimum balance requirements, and cool perks like getting paid up to two days early with direct deposit. Plus, their referral program makes signing up even sweeter with that $100 bonus. Ready? Let’s get you set up!

Frequently Asked Questions

Got questions? We’ve got answers:

Is there a limit to how many people I can refer?

Nope! Refer as many friends as you like—each successful referral nets you another $100, with no cap.

What if I don’t have a referral link?

You can still join Chime, but you won’t get the bonus without signing up through a valid referral link.

How safe is Chime?

Very! Chime partners with FDIC-insured banks, so your deposits are protected up to $250,000. They also use encryption and fraud monitoring to keep your account secure.

What if I miss the 45-day deadline?

Unfortunately, the bonus opportunity expires after 45 days if you don’t receive a qualifying deposit. Set up direct deposit ASAP to avoid missing out.

Are there any fees I should know about?

Chime is mostly fee-free, but watch out for a $2.50 charge for out-of-network ATM withdrawals or over-the-counter cash withdrawals at banks.

Is the bonus taxable?

Yes, it’s considered income. If you earn $600 or more in bonuses in a year, Chime may send you a 1099 form for tax reporting. A single $100 bonus likely won’t trigger this, but it’s good to know.

A Few Things to Keep in Mind

Chime’s a fantastic option, but it’s not perfect for everyone. Since there are no physical branches, customer service is app-based or online, which might not suit those who prefer face-to-face help. Also, while most services are free, those out-of-network ATM fees can add up if you’re not near a partner ATM. On the flip side, Chime’s security—FDIC insurance, real-time alerts, and card-locking features—gives peace of mind.

Conclusion

Chime’s referral program is an easy way to earn $100 while stepping into a modern, fee-free banking experience. By using a referral link and setting up a qualifying direct deposit, you’re not just getting a bonus—you’re joining a platform that simplifies money management. Whether you’re new to online banking or ready to ditch traditional banks, Chime’s worth a look. So, grab a referral link from a friend, sign up today, and enjoy your $100 bonus—it’s that simple!