How to close Flipkart Pay Later account permanently – Follow our expert guide with step-by-step instructions, tips, and FAQs to safely deactivate your Flipkart BNPL account today.

What is Flipkart Pay Later?

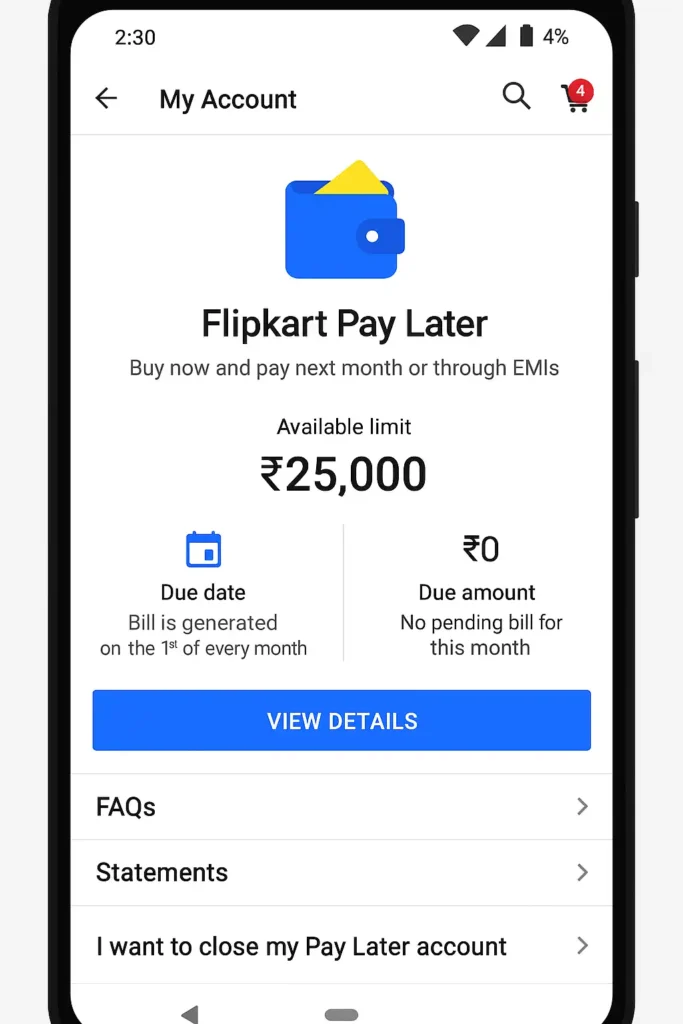

Flipkart Pay Later is a digital credit service offered by Flipkart that allows users to buy now and pay later. Customers can shop for items and defer payment for up to 30 days or convert large purchases into monthly installments (EMIs). This Buy Now, Pay Later (BNPL) feature is especially convenient during sales or when budgeting is tight.

Key Features:

- Instant approval without detailed documentation

- Interest-free period up to 30 days

- EMI options for bigger purchases

- Integrated within the Flipkart app

While it’s a handy tool for many, there are valid reasons why some users prefer to close this account permanently.

Why You Might Want to Close Flipkart Pay Later

Even though Flipkart Pay Later has advantages, many users consider closing their accounts due to:

- High-interest EMIs: Some EMIs come with added charges post the interest-free window.

- Privacy concerns: Sharing sensitive data with third-party NBFCs may be risky.

- Credit report dependency: BNPL services are reported to credit bureaus. Delays can affect credit scores.

- Unnecessary usage temptations: The ease of delayed payments might encourage impulsive spending.

Prerequisites Before Closing the Account

Before you begin the closure process, make sure you meet these conditions:

- Clear all outstanding balances: No dues or EMIs should remain unpaid.

- Unlink auto-pay: If auto-pay is enabled via UPI or bank account, disable it.

- Download statements: Save all historical records in case of future disputes.

- Check credit score status: Visit CIBIL or Experian to verify your credit is updated.

Step-by-Step Guide: How to Close Flipkart Pay Later Account Permanently

Here are the three reliable ways to permanently close your Flipkart Pay Later account:

Method 1: Close via Flipkart App

- Open your Flipkart app and log in.

- Tap on ‘My Account’ in the bottom right corner.

- Navigate to ‘Flipkart Pay Later’ under payment options.

- Look for the Help or Support section.

- Select ‘I want to close my Pay Later account’.

- Follow the on-screen instructions and submit your request.

Method 2: Contact Flipkart Customer Support

If the in-app process doesn’t work, do this:

- Go to the Flipkart Help Center

- Choose Chat with us or Call us

- Ask to connect with a representative regarding Flipkart Pay Later closure

- Provide your registered mobile number, and ensure you’ve cleared dues

- You will receive a ticket number and confirmation once the request is processed

Method 3: Email Request to Flipkart Support

A formal email can also initiate account closure:

📧 Send to: cs@flipkart.com or grievance.officer@flipkart.com

📌 Subject Line: Request to Close Flipkart Pay Later Account

Sample Email Template:

Dear Flipkart Team,

I am writing to request the permanent closure of my Flipkart Pay Later account linked to my registered mobile number [Your Number] and email [Your Email].

All dues have been cleared and no EMI is pending. Please process my account closure at the earliest and confirm via email.

Thank you,

[Your Name]

How Long Does it Take to Close the Account?

Typically, it takes 2–7 working days to process and confirm your Flipkart Pay Later closure. You’ll receive:

- A confirmation email or SMS

- Updated CIBIL/credit bureau reports within 30 days

If you do not hear back, follow up or escalate as mentioned below.

What Happens After You Close Flipkart Pay Later?

Here’s what to expect post-closure:

| Aspect | Effect |

|---|---|

| Credit Score | May see slight dip initially, then stabilize |

| Future Access | Cannot re-enable immediately |

| Data Retention | Flipkart retains limited info for compliance |

| EMI Status | Canceled or marked as “closed” in credit report |

Alternatives to Flipkart Pay Later

If you’re looking to replace Flipkart Pay Later, there are several trusted options:

- Amazon Pay Later: Similar features with easy approval

- Simpl & LazyPay: Popular BNPL services accepted across platforms

- UPI Credit Lines: Banks like HDFC, ICICI offer UPI-based credit

- Credit Cards: Offers longer interest-free periods and better rewards

Choose based on your spending habits, repayment ability, and platform usage.

Common Issues Faced While Closing Account

While most closures go smoothly, here are a few hurdles users often report:

- Support Delays: Responses may take time, especially during sale periods

- Pending Dues Errors: System sometimes shows incorrect unpaid balance

- Rejection Without Reason: Some requests get denied without detailed explanation

- No Credit Bureau Update: Closure not reflected in CIBIL even after 30 days

Always retain screenshots, emails, and ticket IDs for future reference.

How to Escalate if Your Request Is Ignored

If Flipkart doesn’t respond within a reasonable time, escalate your issue:

- Email the Grievance Officer at

grievance.officer@flipkart.com - Raise a Complaint on the RBI CMS Portal at https://cms.rbi.org.in

- File a case on consumer platforms like ConsumerCourt.in or Jagograhakjago.com

- Tweet to @FlipkartSupport publicly with your ticket number

Legal escalation is a last resort but can get quicker results if done properly.

Tips for Managing Your Digital Credit Accounts

Want to avoid similar hassles in the future? Here’s how to maintain financial hygiene:

- Review Statements Monthly: Always verify purchases and EMIs

- Disable Auto Pay on Credit Apps you no longer use

- Limit BNPL Usage: Use it only for essentials or predictable expenses

- Maintain a Personal Ledger: Track due dates and interest terms

- Read Terms Before Accepting Offers: Especially for new loan schemes

Pros and Cons of Using Pay Later Services

| Pros | Cons |

|---|---|

| Instant access to credit | Can lead to impulse buying |

| No paperwork required | High interest after grace period |

| Easy EMI options | Impacts credit score |

| Great for emergencies | Some apps lack transparency |

User Reviews and Experiences

Many Flipkart users have mixed experiences:

- Positive: “Flipkart Pay Later helped me manage expenses during emergencies.”

- Negative: “Took me weeks to close the account and update CIBIL.”

- Neutral: “Great service if used wisely, but needs better support.”

If you’re in doubt, always review your own usage pattern before deciding to close.

Final Thoughts on Closing Flipkart Pay Later

Closing your Flipkart Pay Later account is a smart move if:

- You’re minimizing debt exposure

- You’ve stopped using Flipkart regularly

- You’re improving your credit discipline

- You value data privacy and control

Just ensure you’ve paid off all dues, followed the steps carefully, and confirmed the closure in writing. If handled right, it won’t harm your credit health and can actually simplify your financial life.

FAQs – How to Close Flipkart Pay Later Account Permanently

No, you must first clear all outstanding dues and EMIs.

It might cause a minor dip initially, but it usually improves stability long-term.

Re-enrollment may be possible after a few months, subject to approval.

Yes, use the official support or grievance email addresses for best results.

Usually none, but you may be asked to verify your registered mobile or email.

Yes, they typically notify CIBIL and other bureaus within 30–45 days.