💰Taking control of your finances begins with cultivating the right mindset. The following five books offer invaluable insights to transform your approach to money management and wealth building.

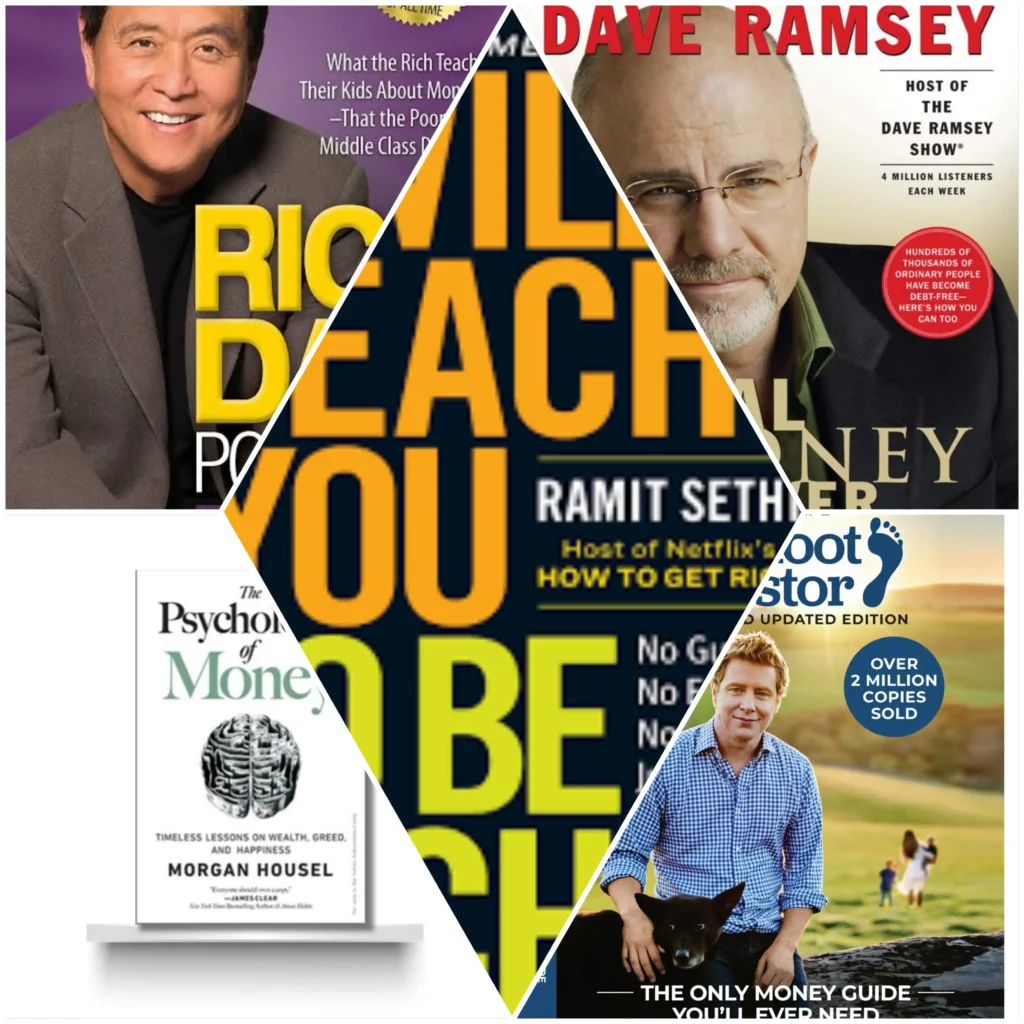

1. Rich Dad Poor Dad by Robert Kiyosaki

“Rich Dad Poor Dad” contrasts the financial philosophies of two father figures: the author’s own educated but financially struggling father (“Poor Dad”) and his friend’s wealthy father (“Rich Dad”). Kiyosaki emphasizes the importance of financial education, investing in assets, and understanding the difference between assets and liabilities. This book challenges conventional beliefs about money and encourages readers to develop a mindset geared toward financial independence.

2. The Total Money Makeover by Dave Ramsey

Dave Ramsey’s “The Total Money Makeover” provides a practical, step-by-step plan for achieving financial health. Ramsey introduces seven “baby steps” to guide readers out of debt and into financial stability:

1. Save a $1,000 beginner emergency fund.

2. Get out of debt using the debt-snowball method.

3. Save a proper emergency fund that covers 3-6 months of expenses.

4. Invest 15% of household income for retirement.

5. Save for children’s college education.

6. Pay off the home mortgage early.

7. Build wealth and be generous.

By following these steps, readers can work towards financial peace of mind. cite turn0search0

3. I Will Teach You to Be Rich by Ramit Sethi

Ramit Sethi offers a modern approach to personal finance in “I Will Teach You to Be Rich.” The book provides actionable advice on automating finances, investing intelligently, and spending consciously. Sethi’s straightforward style makes complex financial concepts accessible, empowering readers to take control of their financial future.

4. The Psychology of Money by Morgan Housel

In “The Psychology of Money,” Morgan Housel explores the behavioral aspects of financial decisions. Through a series of short stories, he illustrates how emotions, biases, and personal history influence our relationship with money. Understanding these psychological factors can lead to more informed and rational financial choices.

5. The Barefoot Investor by Scott Pape

Scott Pape’s “The Barefoot Investor” presents a simple, no-nonsense approach to managing money. Covering topics like budgeting, investing, and creating a financially secure future, Pape provides practical steps that readers can implement immediately. His approachable style makes financial planning less intimidating and more achievable.

Incorporating the lessons from these books can significantly shift your money mindset, equipping you with the knowledge and confidence to take control of your financial destiny.